Magna International may be the world’s most diversified automotive supplier. That’s exactly why it’s vulnerable.

With operations sprawling across seating, electronics, powertrain, body structures, ADAS, and even contract vehicle manufacturing, Magna markets itself as an end-to-end systems partner for global OEMs. But in today’s environment, where agility, specialization, and software-defined innovation are reshaping the value chain, scale alone is no longer an advantage.

Complexity Slows Execution

Magna’s product and regional sprawl requires coordination across multiple business units and technology roadmaps. In fast-moving segments like ADAS, EV powertrains, and cockpit electronics, this complexity can slow response times, dilute accountability, and delay delivery — especially during platform transitions or integration phases.

Breadth Comes at the Expense of Depth

Magna is a participant in nearly every category but a category leader in few. This opens space for specialists to differentiate based on domain expertise, tighter R&D cycles, and product focus — particularly in areas where OEMs value precision engineering, innovation, or performance reliability.

Integration Risk Is Non-Trivial

Large acquisitions (like Veoneer) and joint ventures (like LG Magna e-Powertrain) introduce friction. Alignment of roadmaps, systems, and teams takes time — and during that time, execution risk rises. OEMs seeking speed and clarity may view this as a liability, especially when sourcing for mission-critical subsystems.

Why Now? Timing is Everything

Magna is managing multiple transitions at once:

- Balancing legacy ICE programs with EV growth

- Absorbing Veoneer’s active safety business

- Recovering from the collapse of its Fisker contract manufacturing relationship

In parallel, it faces:

- Warranty cost pressures in its seating business

- Execution uncertainty in ADAS integration

- Exposure to unproven EV startups

- Underperformance in markets outside North America

Magna’s global supply footprint leaves it exposed to tariff regimes, local content mandates, and evolving U.S. industrial policy. OEMs under pressure to localize or IRA-align may look to reduce reliance on suppliers with complex international sourcing structures.

These factors create a temporary but real opening for focused competitors to win share on programs where Magna is seen as underdelivering or misaligned.

If you’re going to chip away at Magna’s market share, now is the moment.

Magna’s 7 Zones of Exploitable Weakness

Magna’s position as the most diversified Tier 1 supplier in the industry brings reach, but also introduces recurring execution friction. The same breadth that allows it to serve multiple systems makes it harder to deliver consistent performance across all of them. The following seven areas represent structural exposure points where competitors can credibly win share.

1. Seating Systems – Profitability and Quality Pressure

Magna’s seating business has posted negative adjusted EBIT margins and increased net warranty costs — a red flag in a mature, high-volume product line. These signals point to either ongoing cost control issues, quality management shortfalls, or both.

For OEMs, this raises questions about program stability. Competitors like Adient — with singular focus and better financial consistency — are well-positioned to challenge on long-term cost predictability, durability, and depth of engineering support. Warranty risk, especially on high-volume platforms, is a growing concern for procurement and program teams alike.

2. ADAS and Electronics – Unsettled Integration Post-Veoneer

Magna’s acquisition of Veoneer’s active safety business gave it a broader ADAS footprint, but also added integration complexity at a time when software alignment and delivery speed are critical. Realigning product roadmaps, teams, and development cycles across two historically separate organizations carries real operational risk.

Competitors with unified software-defined platforms and integrated cockpit/ADAS offerings are already pressing this advantage. OEMs evaluating sourcing options for L2+ or L3 features are watching closely for signs of execution drag, missed handoffs, or organizational ambiguity. Integration takes time and time is a constraint Magna doesn’t control in this segment.

3. EV Powertrain – JV Structure Limits Speed and Control

Magna’s approach to EV propulsion through its joint venture with LG brings capabilities in electronics and e-motor tech, but the governance model adds layers to decision-making. In an environment where EV platforms evolve rapidly and product cycles are compressing, lack of direct control over roadmap, investment timing, and platform-level integration is a disadvantage.

Suppliers with wholly owned architectures and faster development loops (like BorgWarner) are better positioned to align with OEMs that want tighter coupling between hardware and software. The JV’s structure also raises questions around IP boundaries and responsiveness on late-stage spec changes.

4. U.S. Policy Risk and Sourcing Exposure

Magna’s manufacturing footprint includes Canada, Mexico, China, and Eastern Europe, while its U.S. operations are comparatively limited in final assembly and battery-adjacent systems. This creates growing exposure to U.S. policy pressure, including IRA local content rules, tariff volatility, and Buy America provisions.

For OEMs seeking to align with IRA eligibility thresholds or de-risk against future trade shifts, Magna’s structure introduces compliance friction. JV ownership in battery-related components, cross-border dependencies, and the complexity of validating U.S. value-add weaken Magna’s position. U.S.-based suppliers with direct control over sourcing and domestic manufacturing are positioned to take share, particularly in electrification and electronics.

5. Contract Manufacturing – Residual Risk from Fisker

Magna Steyr’s failed relationship with Fisker exposed deeper issues around partner selection and internal prioritization. The financial write-down and public program collapse were visible to every OEM exploring low-volume EV outsourcing and raised fair questions about Magna’s ability to support programs where the OEM depends on them for end-to-end execution.

Contract manufacturers with narrower focus and clearer accountability, such as Valmet, will find a more receptive audience among startups and niche OEMs that want hands-on support, consistent communication, and launch discipline. Magna’s diversified model means complete vehicle builds are just one of many business lines — not the core. That matters when programs get difficult.

6. Specialized Systems – Vulnerable to Category Leaders

Magna’s presence across dozens of product lines limits its ability to lead in any one. In competitive awards for roof systems, interiors, lighting, or other high-visibility categories, OEMs often look for suppliers who go deeper: on design, innovation, or engineering responsiveness.

Specialists like Webasto (roof) or Yanfeng (interiors) have a stronger claim to leadership and deliver tighter alignment with OEM engineering and design teams. This is particularly true on premium platforms, where component-level differentiation directly supports brand positioning. When every touchpoint matters, breadth becomes a disadvantage.

7. Organizational Complexity – Execution Drag in Transition

Magna has entered a restructuring phase across several divisions in pursuit of improved margins. While strategically sound, these changes create turbulence at the operating level: talent turnover, revised handoffs, and internal distraction all carry delivery risk.

OEMs launching time-sensitive programs or planning platform transitions have limited tolerance for supplier instability. Competitors with flatter orgs and steady commercial interfaces can credibly claim lower delivery risk and faster decision-making during program escalation. The window for displacement is narrow — but real.

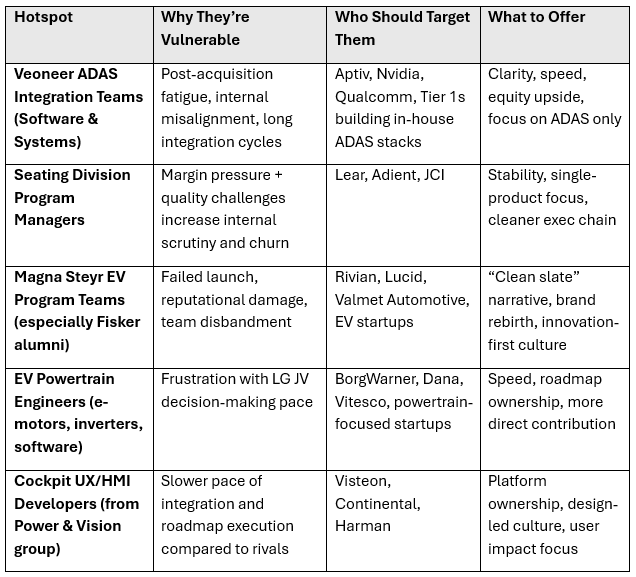

Asymmetric Competition: Talent Edition

Competing with Magna doesn’t only happen in RFP rooms. It also plays out quietly through organizational shifts, internal friction, and employee mobility. Structural complexity from acquisitions, JVs, and program failures has created areas of latent talent risk. For rivals, this presents a chance to build capabilities faster, if approached with discretion and discipline.

Key strike zones:

Talent Strategy Considerations

1. Timing Is Predictable

Role changes, roadmap uncertainty, and shifting org structures often follow major transitions such as acquisitions, spinouts, or JV realignment. These moments tend to drive voluntary exits, especially among mid-level technical and program staff.

2. Focus on Execution-Critical Layers

Engineering managers, systems leads, and program coordinators are often the connective tissue in product and delivery organizations. These roles tend to feel instability first and move early.

3. Build for Knowledge Continuity

When hiring, emphasize shared product lineage, not just resumes. Bringing in a few professionals who’ve worked together previously (on the same platform or subsystem) can accelerate onboarding and reduce friction especially in mission-critical systems like ADAS, propulsion, or HMI.

4. Geographic Awareness Matters

Certain regions carry a higher concentration of at-risk roles:

- Canada – ADAS, integration, and senior tech leadership

- Austria (Graz) – Vehicle engineering, low-volume platform build

- Detroit – Seating, driveline, program operations

- South Korea – LG JV coordination and systems development

5. Stay Within Ethical Guardrails

Nothing here suggests violating contractual restrictions or soliciting employees under active non-competes. The intent is to recognize natural friction points where mobility is already in motion and respond accordingly by creating a compelling home for high-value talent.

How Magna Fights Back

Magna won’t just defend its position with scale and incumbency. It will actively respond when challenged. Below are the likely countermeasures Magna may deploy when competitors attempt to exploit any of its known vulnerabilities.

1. Seating: When Warranty and Margin Weakness Are Targeted

If a competitor challenges on warranty reliability, cost performance, or innovation cadence, Magna is likely to respond in three ways:

- Reprioritize internal resources to shore up quality metrics or temporarily buy margin by absorbing costs to retain strategic programs.

- Leverage pricing bundles across multiple domains (e.g., seating + trim or seating + HVAC) to undercut standalone bids.

- Use deep customer relationships to reframe the issue as transient and already under correction, buying time to avoid losing the award.

Implication: The quality gap may close quickly. Make your case with third-party data and internal OEM benchmarking before Magna resets the narrative.

2. ADAS: When Competitors Exploit Integration Lag Post-Veoneer

If challenged on ADAS roadmap cohesion or system maturity, Magna will likely:

- Accelerate internal consolidation efforts, reorganizing teams or reassigning product ownership to reduce friction.

- Push co-development partnerships with OEMs, allowing them to directly shape platform direction and creating switching friction.

- Position their roadmap as more complete, emphasizing breadth (ADAS + central compute + integration) over competitors’ depth.

Implication: The more a competitor frames Magna’s integration as a risk, the faster Magna will offer joint development or customization to defuse that risk.

3. EV Powertrain: When the JV Structure Is Challenged

If a competitor targets the LG JV as a bottleneck, Magna will likely:

- Reposition the JV as a strength, emphasizing manufacturing scale, LG’s battery and inverter tech, and joint investment capacity.

- Isolate JV governance from program execution, assuring OEMs that response time and ownership are handled locally.

- Apply pricing or capacity incentives at the component level to blunt the JV agility argument.

Implication: Be ready for Magna to segment its JV messaging depending on whether the audience cares more about innovation or deliverability.

4. U.S. Policy and Sourcing Exposure: When IRA Misalignment Is Highlighted

If a competitor leads with IRA alignment or tariff insulation, expect Magna to:

- Accelerate reshoring of final assembly or critical subcomponents, especially in electronics and powertrain.

- Seek OEM exemptions or transitional flexibility by leveraging its political capital and existing long-term agreements.

- Reframe the issue as temporary — arguing that Magna’s footprint is under active reconfiguration and not materially different from other global suppliers.

Implication: Competitors have a short window to lead with policy compliance. Once Magna announces a local investment or exemption, the differentiation may evaporate.

5. Contract Manufacturing: When Steyr’s Track Record Is Attacked

If competitors highlight the failed Fisker partnership, Magna is likely to:

- Pivot toward established OEMs only in near-term bidding to minimize perceived risk.

- Offer guaranteed milestone-based commercial terms to de-risk the structure for new EV programs.

- Shift messaging to Steyr’s volume flexibility and launch history, distancing from outliers like Fisker and emphasizing Mercedes, BMW, and JLR credentials.

Implication: Use the Fisker example carefully — Magna will isolate it as an anomaly and reframe Steyr as a safe pair of hands with serious OEMs.

6. Specialist Competitors: When Category Depth Is Used as a Wedge

If a supplier competes on interior, roof, or electronics specialization, Magna will likely:

- Reinforce its integration advantage by bundling modules (e.g., roof + lighting + electronics) into a single system offer.

- Highlight recent investments or partnerships in the challenged domain to neutralize perceived innovation lag.

- Push for pilot awards or subsystem co-development to stay in the game and prevent full displacement.

Implication: Don’t assume Magna will compete directly — they may go around the problem by bundling or resetting the frame entirely.

7. Restructuring: When Competitors Bet on Organizational Instability

If you position your company as more agile during Magna’s internal transition, Magna will counter by:

- Deploying executive sponsorship to stabilize commercial relationships, ensuring key customers are insulated from internal change.

- Pulling in leadership air cover (e.g., EVP or group presidents) to directly engage on troubled accounts or sensitive RFPs.

- Accelerating visible wins in the restructuring units, even at lower margin, to signal turnaround progress.

Implication: If you're counting on chaos, it won’t last. Strike early and with evidence — not vague promises of speed — or Magna will move first to control the narrative.

Where Challenger Strategies Can Backfire

Not every angle of attack is equally productive. Below are defensive considerations that competitors must keep in mind when crafting positioning strategies, particularly where missteps can erode credibility or lead to dead-end pursuits.

Over-indexing on Specialist Depth in Systems Where OEMs Value Integration

Pitching specialist superiority in areas like ADAS, cockpit electronics, or interiors can fall flat if the OEM’s priority is system-level integration and software alignment. Magna’s ability to tie together mechanical, electronic, and software subsystems into a unified architecture — even if imperfect — carries weight in sourcing where modular conflict is a risk.

Watchout: When the OEM wants fewer integration points, pushing a standalone subsystem as “best-in-class” may be seen as additive complexity, not value.

Underestimating Program-Level Influence in Vehicle Manufacturing

Challenging Magna Steyr based on the Fisker fallout makes sense in EV startup contexts, but carries real risk when engaging with established OEMs. Magna’s history with Mercedes, BMW, Jaguar Land Rover, and others gives it credibility as a launch partner for low-volume or specialty platforms, especially when vertical integration or internal capacity is constrained.

Watchout: In legacy OEM contexts, leaning too hard into “Magna can’t deliver vehicles” will misfire. Their track record still resonates in engineering circles.

Overemphasizing North American Exposure in Global Programs

While it’s true that Magna’s financial exposure leans North American, operationally they remain globally embedded, especially in powertrain, seating, and structures. They often win business not because of their footprint, but because they’re already pre-integrated into global vehicle architectures spanning Asia and Europe.

Watchout: Challengers relying on geographic differentiation need to validate whether the target program is truly regionalized. If it’s a global platform, Magna’s embeddedness may be an asset, not a liability.

Assuming Structural Change Means Execution Risk

Magna’s restructuring efforts and organizational realignments do create friction — but the assumption that these transitions slow delivery can backfire. In many cases, restructuring is used precisely to shore up delivery timelines and client satisfaction in critical programs.

Watchout: If a competitor publicly suggests Magna is “too distracted to deliver,” but Magna is already stabilizing with new leadership or refreshed account teams, the challenger may look uninformed. Competitive intelligence and market developments need to be up to date and GTM tactics needs to be refreshed as needed.

Pitching Feature-Level Differentiation Where Procurement Cares About Stability

In cost-constrained procurement cycles — especially post-COVID and amid IRA-driven shifts — program teams may prioritize continuity, risk mitigation, and commercial predictability over features or theoretical performance edge.

Watchout: If your entire message hinges on technical superiority, but Magna is offering guaranteed delivery windows, warranty caps, and volume incentives — your differentiation may not be enough.

Strategic Outlook

Magna is vulnerable not because it’s weak, but because it’s wide. Its scale, diversification, and integration-heavy model create friction across multiple domains: from margin erosion in seating and integration drag in ADAS, to JV constraints in EV propulsion and policy misalignment in a reshaping U.S. industrial landscape.

The opportunity for competitors is clear:

- Target instability where it exists (Seating, ADAS), but do it fast.

- Exploit where Magna’s structure imposes internal lag (JV models, cross-border sourcing).

- Go deep where Magna goes broad, especially in systems that define customer experience or carry high commercial risk.

- Focus on incremental platform wins, not wholesale displacement.

But every challenge invites a counter. Magna has shown a consistent pattern: it stabilizes under pressure, leverages platform incumbency, and outlasts weaker competitors. Mispositioning, overreaching, or underestimating their ability to reset the game can erode hard-won credibility.

The competitors that win in this environment won’t just be cheaper or faster — they’ll be clearer. Clearer in what they own, what they can deliver, and how they’ll navigate the counter-response.