U.S. Treasury Secretary Scott Bessent recently attempted to lend intellectual weight to the Trump administration’s renewed tariff blitz by invoking game theory.

“In game theory it’s called strategic uncertainty,” he told ABC News, explaining the White House’s erratic posture toward China and Europe. “You’re not going to tell the person on the other side of the negotiation where you’re going to end up.”

The statement is revealing. Not because it reflects a sophisticated grasp of strategic theory—it doesn’t—but because it shows the administration believes its improvisational, pressure-maximizing approach is defensible as rational unpredictability. That belief is wrong. Not only does it misinterpret the role of uncertainty in strategic games, it ignores a more important dynamic at work in 2025: learning across repeated play.

Game theory is not a metaphor to be thrown out as a sound-bite to an uncurious press corps. It is a rigorous toolkit for analyzing decision-making among interdependent actors. And when applied properly, it reveals why the current U.S. trade strategy is unlikely to produce its intended outcomes—whether that's reshoring, forcing favorable concessions, or re-centering U.S. industrial power.

Before I pivoted 25 years ago to international business strategy and strategic intelligence, I was an expert in applying game theory to model the behavior of nuclear-armed states locked into decades-long rivalry (LMK if you want to nerd out about that). Decoding the current U.S. trade and tariff policy through the lens of game theory is relatively low-stakes child’s play in comparison!

Let’s get into it.

Misunderstanding Strategic Uncertainty

In formal game theory, strategic uncertainty refers to the lack of knowledge a player has about the future moves of other players. This is not the same as risk, where probabilities are known. Nor is it ambiguity, where probabilities are unknown. Strategic uncertainty is unique: it arises from opponents having agency, memory, and strategic reasoning.

The Trump administration treats strategic uncertainty as if it were a lever: increase unpredictability, and your opponent backs down. This interpretation conflates the existence of uncertainty with the weaponization of inconsistency. It draws from an incomplete version of brinkmanship—one that omits the crucial role of credible signaling, commitment mechanisms, and reputation.

Game theory does allow for unpredictability, but only when it is carefully deployed as part of a known model—typically as a mixed strategy in zero-sum or conflict games. That is not what is happening in 2025. The administration’s behavior is better modeled as noisy signaling: inconsistent, difficult to interpret, and increasingly discounted by other players. That isn’t uncertainty. It’s incoherence.

The Lessons of 2017–2020 Haven’t Been Forgotten—Except in Washington

Game theory doesn’t end at the boundary of a single interaction. Repeated play—across time, administrations, and crises—fundamentally shapes strategy. In 2025, the administration is not dealing with naïve or static opponents. China, the EU, Canada, Japan, and Mexico have all experienced this script before. They are not facing the first iteration of the game; they are playing the next round with updated expectations.

I would argue that in addition to the lessons from Trump 1.0, other countries have learned valuable lessons from playing multiple rounds of this game during the first 100 days of Trump 2.0 as well. The Trump administration has been kind enough to deliver their opponents a lot of practice, and opportunities for learning.

In repeated games, particularly those with incomplete information, learning is central. Players update their beliefs about their opponent's preferences, reliability, and thresholds for action. And the Trump administration has already taught them:

- That threats are rarely backed by sustained, enforceable commitments.

- That signaling is frequently reversed within hours, days or weeks.

- That concessions often result in further escalation, not resolution.

- That allies can be treated as adversaries, making trust-based coordination fragile.

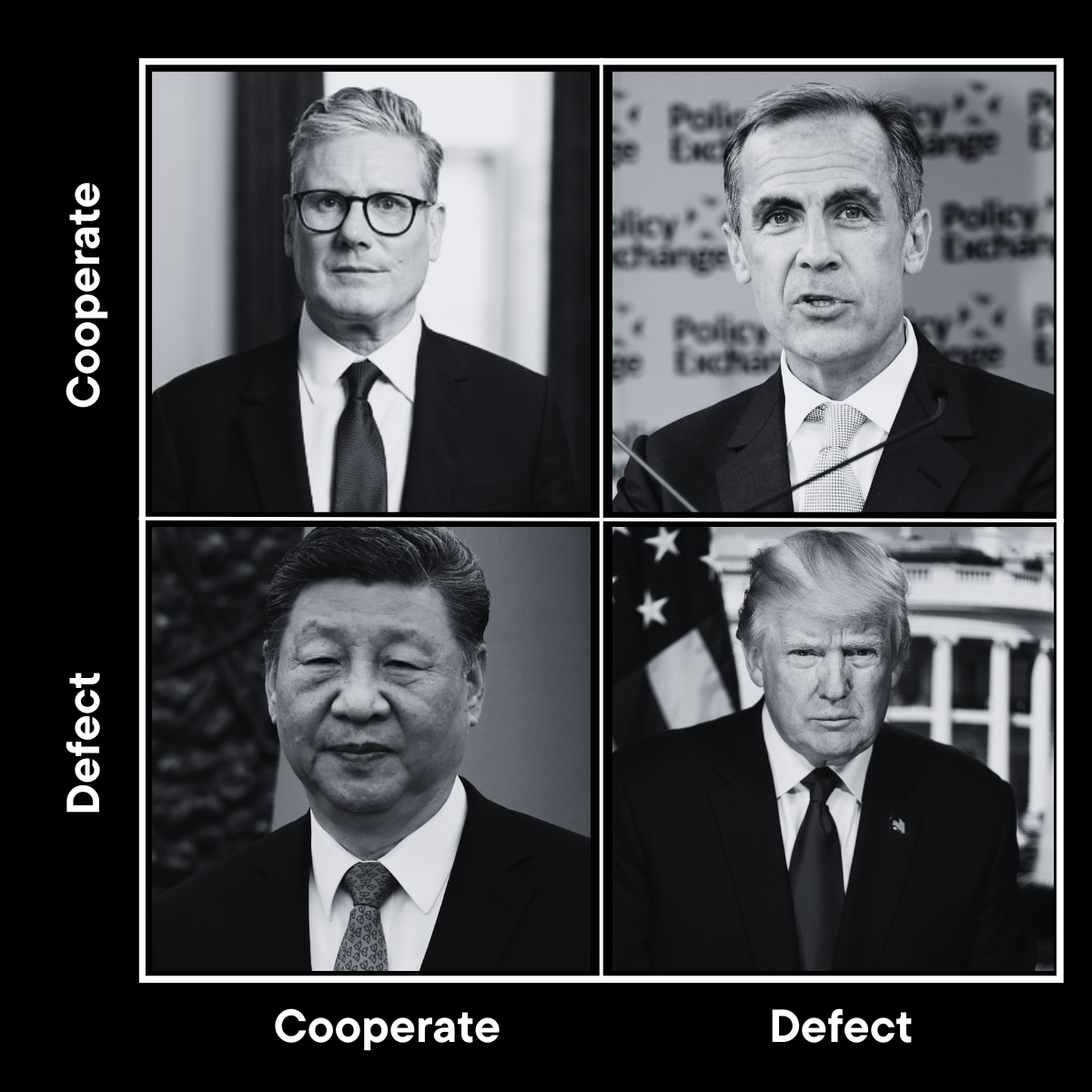

If game theory treats the international trading system as a repeated Prisoner’s Dilemma or a variant of Chicken, the administration is now viewed as a player with a high defection probability and no stable payoff function. Rational players adapt to that by insulating themselves, building parallel coalitions, or removing cooperation as a viable equilibrium.

We see evidence of each adaptation strategy today.

1. Insulating Themselves

Objective: Reduce exposure to U.S. trade unpredictability

- China: Accelerating the development of the Cross-Border Interbank Payment System (CIPS) to reduce reliance on SWIFT and dollar-based transactions. Also promoting RMB settlement in Belt & Road partner countries to insulate against future U.S. financial sanctions or tariffs.

- European Union: Reviving interest in “open strategic autonomy” by reshoring critical supply chains in green tech, EV batteries, and semiconductors—specifically to reduce reliance on both the U.S. and China.

- India: Rejecting U.S. pressure on digital trade provisions in favor of its own data localization policies and developing domestic alternatives to U.S. platforms and e-commerce standards.

2. Building Parallel Coalitions

Objective: Coordinate trade strategy outside of U.S.-centric frameworks

- RCEP (Regional Comprehensive Economic Partnership): Deepening integration across ASEAN, China, Japan, and South Korea. RCEP now governs nearly a third of global trade and excludes the U.S., allowing Asian economies to align norms and tariffs without American involvement.

- EU–Latin America Trade Deals: The EU is advancing talks with Mercosur—creating alternatives to U.S.-dominated hemispheric arrangements.

- China–Middle East Partnerships: China is signing long-term energy, logistics, and infrastructure deals with Saudi Arabia and the UAE, including yuan-based pricing mechanisms that bypass Western pressure levers.

3. Removing Cooperation as a Viable Equilibrium

Objective: Treat U.S. trade behavior as unpredictable and default to defensive strategies

- Mexico and Canada: Post-USMCA, both countries have begun to diversify export dependencies, investing heavily in bilateral, European and Asia-Pacific markets to hedge against future Section 232-style tariffs from Washington.

- Japan and South Korea: Increasing bilateral defense and trade coordination with each other and with ASEAN—treating the U.S. as a volatile partner, not a guaranteed anchor.

- WTO Dynamics: Multiple countries (e.g. India, Brazil) are backing WTO reform proposals that explicitly sidestep U.S. veto power—pursuing plurilateral deals and dispute settlement mechanisms independent of U.S. engagement.

Where the Current Game Is Likely to Lead

Game theory offers useful templates for anticipating outcomes. The most relevant models for 2025 are:

1. Repeated Chicken with Noisy Signaling

Both players escalate, hoping the other will “swerve.” But if signals lack credibility—and if both sides believe the other might miscalculate or refuse to back down—the likely outcome is not concession but crash. That’s where Trump’s tariff strategy heads, especially with China, if both sides perceive erratic resolve and low learning.

2. Multi-Player Coordination Breakdown

When the U.S. simultaneously threatens trade penalties against adversaries and allies, it disrupts cooperative equilibria. This triggers what game theorists call equilibrium unraveling: players no longer trust that cooperation will be rewarded, so they hedge, defect, or form alternative coalitions. The erosion of trust in U.S. leadership at the WTO and in multilateral trade frameworks is a concrete example.

3. Signaling Game with a Perceived Irrational Player

If the U.S. continues to behave in ways that appear disconnected from consistent payoffs—randomly punishing partners, shifting justifications, ignoring prior deals—then other players model it not as a rational maximizer but as an unstable type. In signaling games, the presence of a perceived irrational player undermines both deterrence and inducement strategies. Neither threats nor offers are believed. Cooperation collapses.

What a Game Theory Expert Would Recommend—If The Administration Were Actually Serious

If the Trump administration were sincerely trying to use game theory to achieve reshoring, fairer trade terms, or industrial revival, the path would be very different.

It would involve:

- Clear Payoff Mapping: Explicitly define what success looks like—not just in terms of headlines but in measurable changes to supply chains, investment flows, or bilateral balances.

- Credible Signaling: Make fewer threats, but ensure that those issued are credible. That means building domestic consensus (audience costs), codifying positions in law or treaty (tying hands), and avoiding abrupt reversals (no cheap talk).

- Exploiting Incomplete Information Strategically: Use private negotiation channels to explore red lines and mutual concessions. Public volatility is not a substitute for controlled ambiguity.

- Targeted Escalation, Not Blanket Pressure: A narrow game focused on one or two high-priority tradeoffs is far more winnable than global escalation. Game theory favors defined games, not diffuse warfare.

- Trust and Institutions: In repeated games, trust is an asset. Rebuilding it—especially with allies—is a precondition to any stable cooperative equilibrium. The WTO, USMCA, other trade compacts, and coordinated rules-of-origin regimes are not constraints; they’re mechanisms for enforcing payoffs.

- Dynamic Adaptation Based on Opponent Learning: Recognize that China and others are not static players. They are learning—and responding—not just to actions but to reputational signals. A strategic player in 2025 incorporates opponent learning curves into its own behavior.

A Theory of the Case

The 2025 trade doctrine unfolding under Trump 2.0 is not game theory. It’s simply the misuse of a term to justify improvisation and volatility. The evidence from 2017–2020 should have been instructive. Instead, the same behaviors are being repeated in a more fragile geopolitical and economic environment—with adversaries and allies now better prepared.

If the goal is to maximize U.S. leverage, reduce dependency, and restore industrial competitiveness, game theory offers tools. But those tools require structure, discipline, and long-term credibility. What’s happening instead is tactical noise misinterpreted as strategy, disrupting a system that depends on consistent signals and rational play.

A country cannot bluff its way to stable equilibria. And it cannot compel cooperation while actively dismantling the mechanisms that make cooperation rational.

In 2025, the world is not guessing what America might do. It’s remembering what it already did, and playing accordingly.

Applying Game Theory to Your Competitive Strategy

Companies navigating this environment don’t need more noise—they need structured thinking. I help leadership teams apply real game theory to real competitive problems: how to pressure rivals and suppliers without overextending, how to signal credibly in uncertain markets, how to identify stable winning positions and avoid mutually damaging cycles. Whether you’re rethinking market entry, pricing, supplier strategy, or global risk, game theory—applied properly—can help you play to win.