Trends, Pain Points and Strategies for Success

The U.S. flooring industry is no longer navigating slow waters. It is navigating discipline. Growth is no longer broad-based or automatic. It is now concentrated in fewer, higher-performing segments and increasingly shaped by sharper buyer expectations. The return of demand has not brought back old buying behavior. Instead, it has exposed structural inefficiencies that many brands are still racing to correct.

This report delivers actionable intelligence on the U.S. residential flooring market, backed by 750+ inputs collected from dealers, designers, homeowners, and flooring company executives. Whether you're a manufacturer, investor, supplier, or distributor, you need this report to stay ahead in a competitive market.

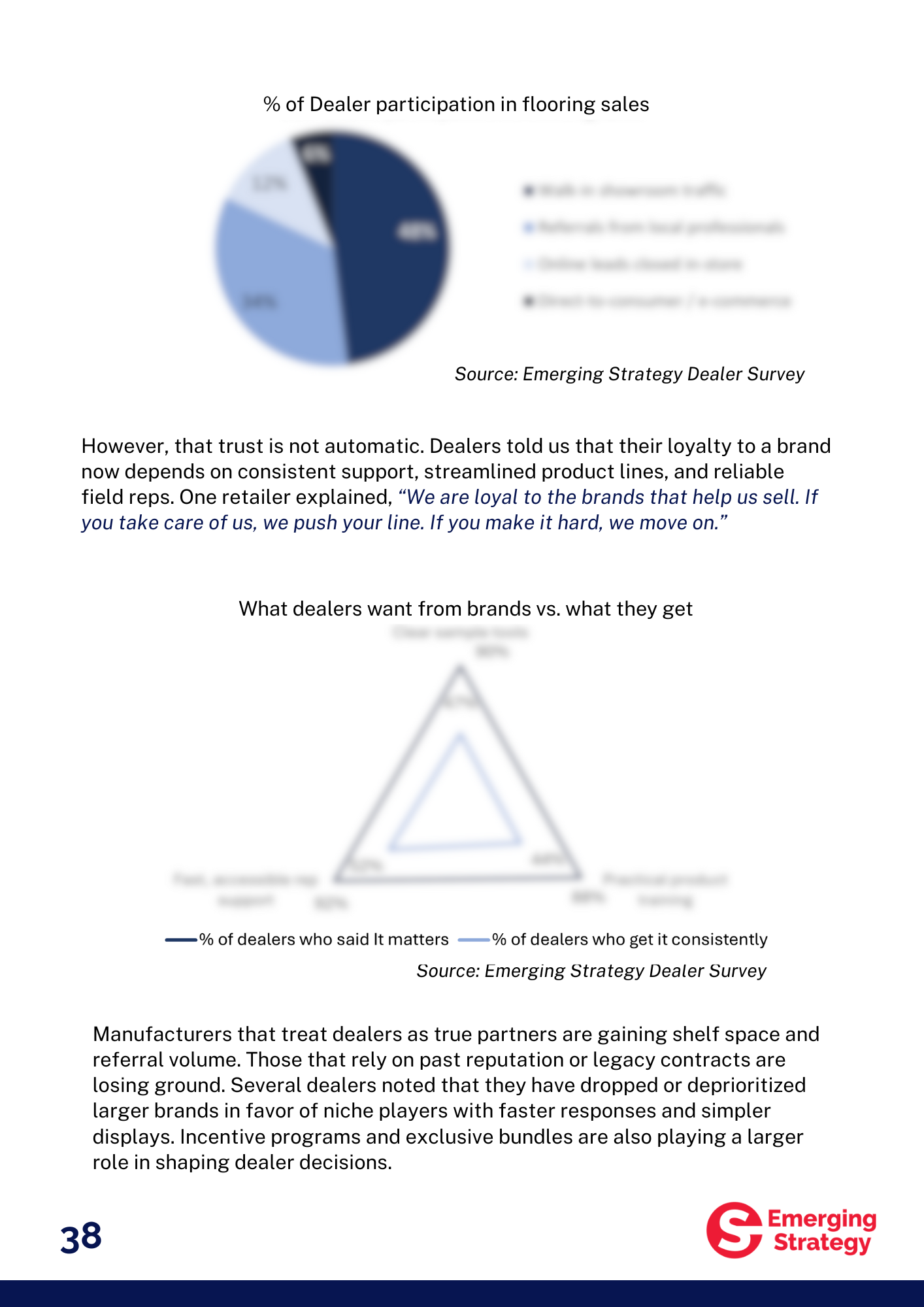

Flooring brands are not being outcompeted on product quality. They’re being eliminated on clarity, responsiveness, and support. Whether the buyer is a dealer deciding what to recommend, a designer finalizing a spec, or a homeowner choosing what to install, the common thread is friction, and the brands that remove it are gaining share.

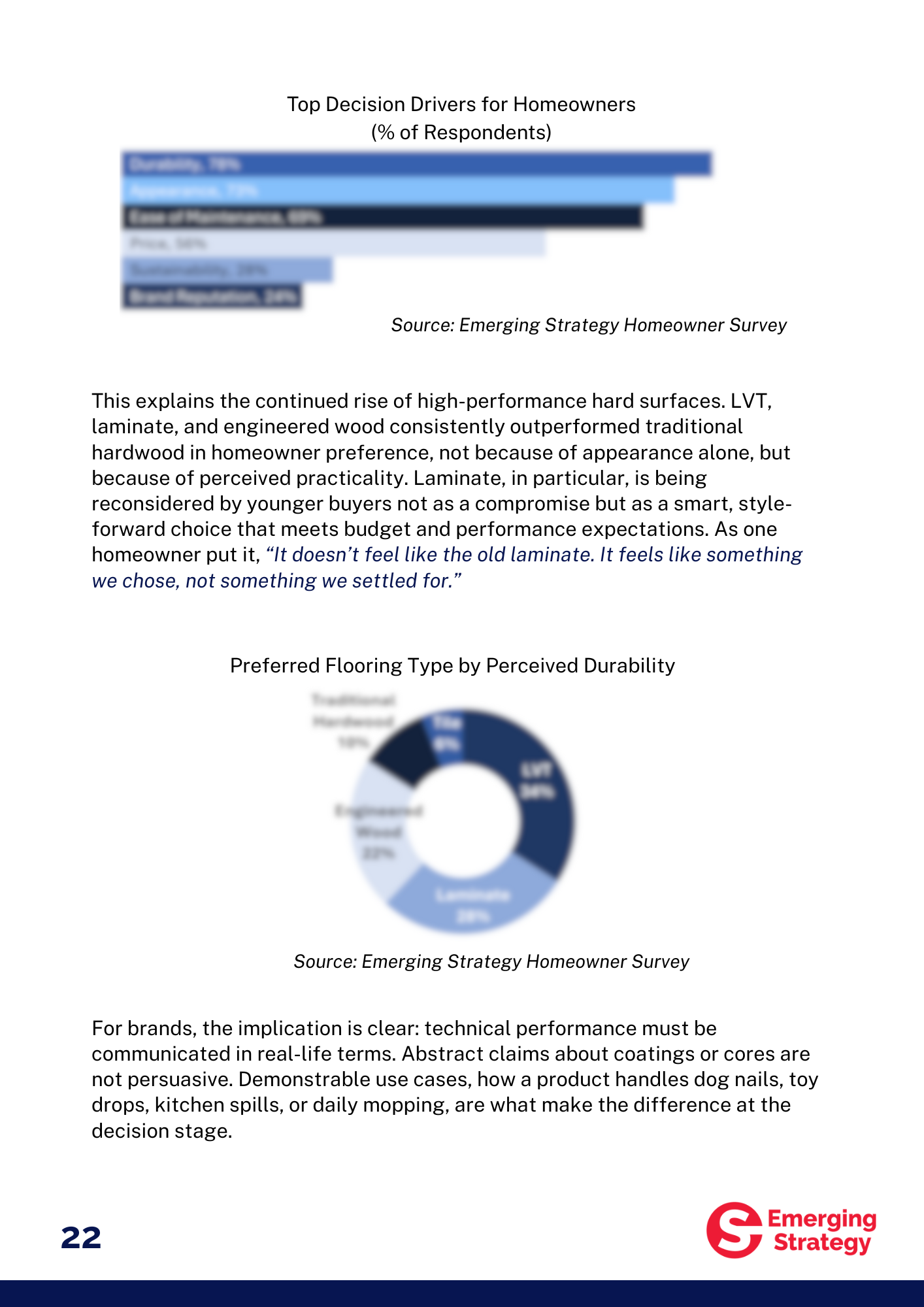

Our interviews and surveys reveal recurring breakdowns across the decision journey. The categories seeing the fastest growth, LVT, engineered wood, and now laminate, are no longer competing only on features. They are winning because they are easier to explain, easier to quote, and easier to trust.

What does the report contain?

Results of in-depth interviews and surveys with dealers, designers and homeowners

- Key trends in types of flooring gaining popularity

- Pain points identified by dealers and designers affecting flooring sales

- Strategies to reduce friction in flooring distribution and sales channels

- ... and more

Report Preview