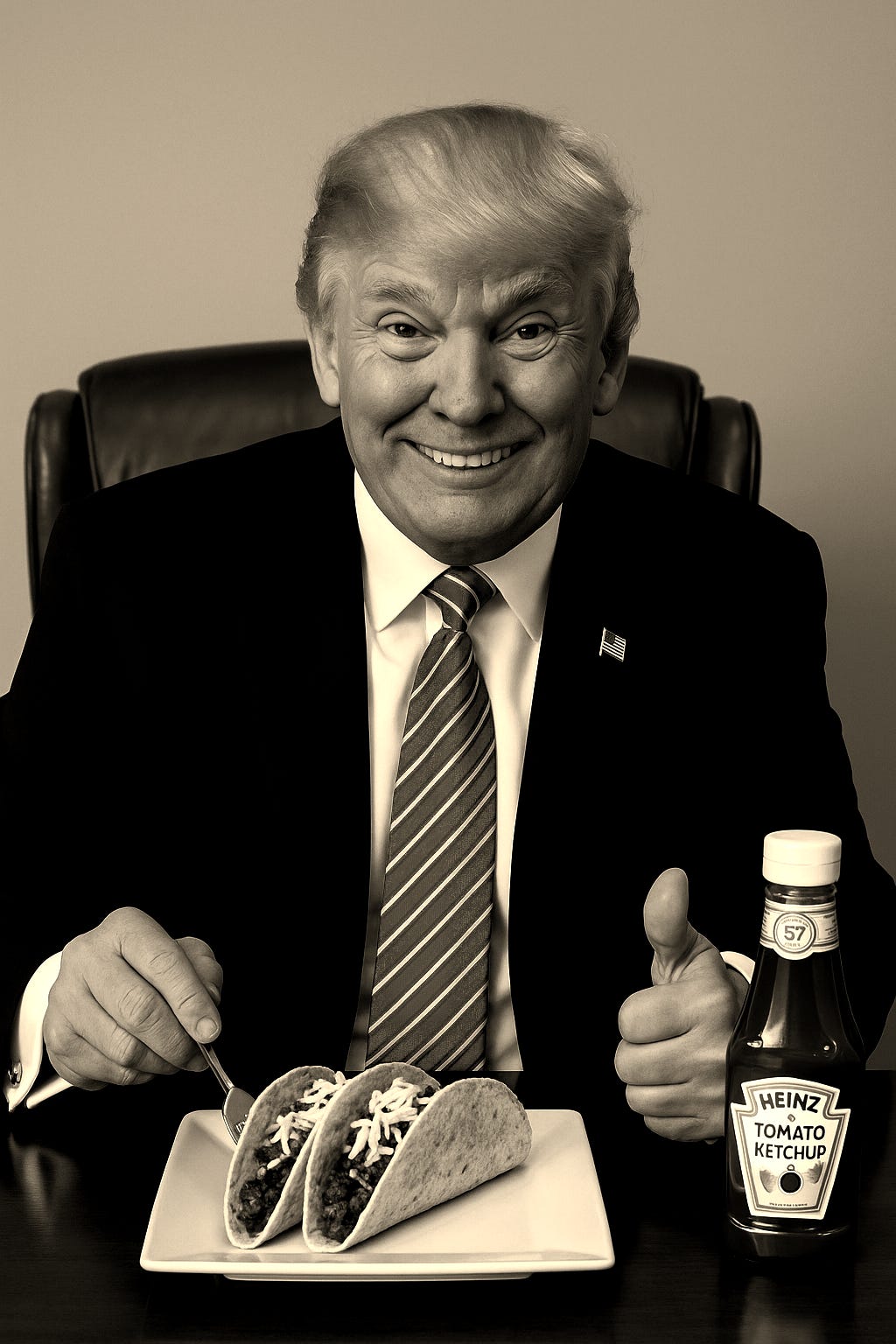

Have you heard of the TACO trade? You’ve definitely lived through it. The U.S. administration threatens tariffs. Markets tank. $6 trillion in value vanishes in two days. Then the administration backs down: partially, fully, or indefinitely, and everything mostly rebounds.

The finance bros on Wall Street have coined TACO: Trump Always Chickens Out. It sounds funny, but for many U.S. importers, it’s anything but fun.

But here’s what many executives miss, within major importers I work with: This is a structural opportunity. And it’s not going away.

If you’re a U.S. company with deep import exposure across raw materials, finished goods, or components, the TACO cycle is now part of the ambient business climate. It’s not a crisis. It’s fairly predictable.

The smartest companies aren’t merely protecting themselves.

They’re profiting from it.

What’s Actually Happening?

The TACO pattern is poorly executed negotiation theater built on a mix of genuine leverage, performative toughness, and legal uncertainty. The U.S. goes maximalist: 145% tariffs on China, 50% on the EU, 25% on Canada and Mexico. The market panics. Then comes the walk-back. A 90-day pause. A negotiated reduction. A legal injunction.

Sometimes the pullback is strategy. Sometimes it’s because the bluff was called. Sometimes it’s the courts. Either way, it’s repeatable. And that makes it playable.

In game theory terms, it’s a repeated game with noisy signals: the U.S. administration escalates to create perceived leverage, then backpedals. Over time, market actors learn to discount the threats unless accompanied by credible commitments. But the noise still creates opportunity for players who interpret signal faster than the rest.

TACO Isn’t Risk. It’s a Timing Window.

Most businesses are still reacting to these announcements like they’re one-off events. But the volatility is patterned. Market drops when threats hit. Market rebounds when the retreat begins. It’s the same loop every time. You can plan around it, so you’re not leaving money on the table.

Some investment firms are already building portfolios around TACO cycles. But this isn’t just a Wall Street game. Real businesses—your business—can use this volatility to make better purchasing decisions, smarter supplier shifts, more profitable timing calls.

The opportunity lies in the asymmetry of interpretation. This isn’t a full-information game. Most actors are reacting to headlines; a few are responding to ground-truth signals. That’s where alpha lives. Not in predicting the policy move, but in exploiting the lag between policy noise and market action.

Win the Trade War with Data

The winners in a TACO environment are the ones who can see clearly when others are guessing. That means:

- Knowing where every part and product is sourced from.

- Tracking supplier risk at the facility level.

- Understanding real landed costs, not just invoice prices.

- Watching for court rulings that could retroactively refund your tariff payments.

But visibility isn't the same as clarity. Most systems flag the what. Very few give you the why behind supply shifts, quote changes, or sudden vendor silence.

Whiplash Is Part of the Game

On May 29, a federal court ruled the IEEPA-based tariffs unconstitutional. Then it got stayed. Now it’s headed to appeal. If the ruling stands, companies that paid millions in emergency tariffs could get refunds. If it doesn’t, the White House might pivot to Section 122, which carries a 150-day clock.

How good are your records? Do you have clean data on what you paid? How it was classified? Where it came from? Is your general counsel tracking the moving ground under your supply chain?

Tariff reversals also expose the fragility of incomplete contracts across global supply chains. When the rules shift mid-game, bargaining theory tells us that the side with better information and fallback positions wins. Companies with early insights into supplier recalibration via primary intelligence negotiate from strength.

Build Strategic Options

You’ve already heard: diversify your supply base. But have you built the operational agility to act when tariffs strike?

The most resilient players can shift production volume in days. They’ve pre-qualified vendors in tariff-safe zones. They’ve negotiated flexible contracts. And they know exactly which SKUs to pull forward into inventory when the window opens.

Recent Case Study

Emerging Strategy recently worked with a Fortune 500 U.S. packaging company facing an opaque supplier environment in China and Southeast Asia, and significant day-to-day uncertainty. They were also unsure how tariff chaos was affecting competitors’ import strategies and volume.

Off-the-shelf reports were vague and outdated, and HS code data was riddled with inaccuracies due to inconsistent product classification. The only way to figure out what was really going on was to go directly to the source.

Emerging Strategy approached leading U.S. and Asia-based manufacturers, importers, and exporters, holding in-depth conversations to understand supplier pricing and operational decisions, competitor volumes, and trading strategies. The intelligence and analysis generated within just a few weeks is enabling the client to take fact-based decisions about timing their imports, and negotiating with U.S. enterprise customers.

Tariffs = Signal, Your KPIs = System

How quickly will your internal systems register the impact when tariffs change again?

You should be tracking:

- Which suppliers are under pressure.

- Where COGS is deviating from baseline.

- How fast inventory is turning.

- Whether your customs clearance times are changing.

Flying blind on these metrics means the damage shows up in margin compression and backorders.

It’s not about plugging in more tech. It’s about asking better questions and getting answers that decision-makers trust.

The Ceasefire is the Moment to Move.

Every time the tariffs are delayed, the market breathes a sigh of relief. That’s when most companies stop moving. That’s a mistake.

The smart ones: Stanley Black & Decker, Columbia Sportswear, Best Buy, treat the pause as a planning sprint. They renegotiate contracts. Shift inventory. Reassess market pricing. They actively reallocate.

The quiet weeks are when the winners are pulling ahead. In a TACO world, the advantage goes to the fast, the informed, and the operationally fluent.

TACO isn’t a one-shot deal. It’s a sequential game where fast movers lock in optionality before others wake up. You don’t need to outguess the administration. You just need to act before your competitors realize the window opened.

If you want to stop reacting to tariff noise and start executing based on what's actually happening inside your ecosystem, Emerging Strategy can help with intelligence gathered from the people who already see what’s coming.

We don’t just use game theory to sound clever (though it does sound clever, doesn’t it? 😎) We combine game theory with primary source intelligence to understand how actors with imperfect information and asymmetric incentives actually behave. That’s how our clients find leverage.

No fluff. No finance-bro jargon. Just clarity where it matters most.