In dozens of districts this fall, superintendents discovered that keeping the lights on had become a financial strategy. Payroll cleared only because of short-term credit. Classroom budgets froze while state aid sat in limbo.

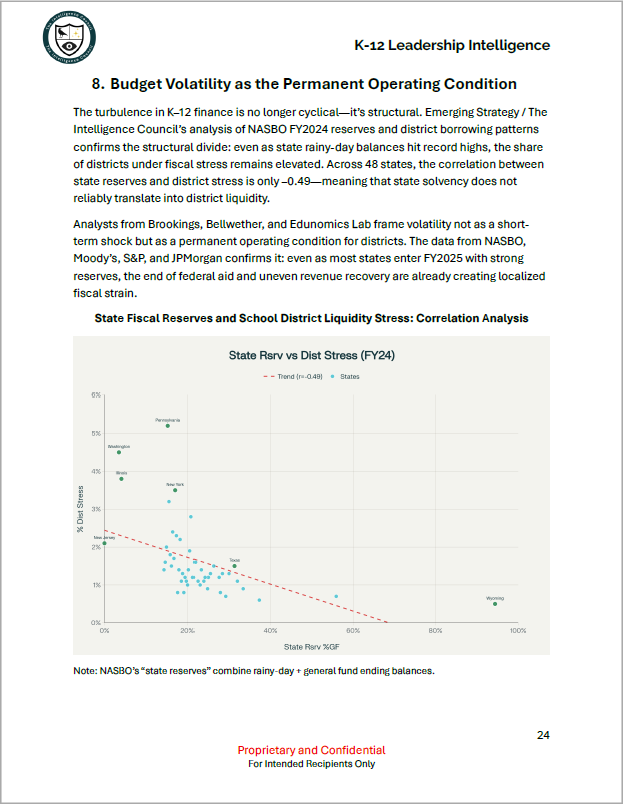

Emerging Strategy / The Intelligence Council’s analysis shows a structural fault line in public education finance: even as many states boast record rainy-day funds, district liquidity is eroding. Across states, the correlation between state reserve strength and district fiscal stress is just –0.49: proof that state solvency no longer guarantees predictable funding for schools.

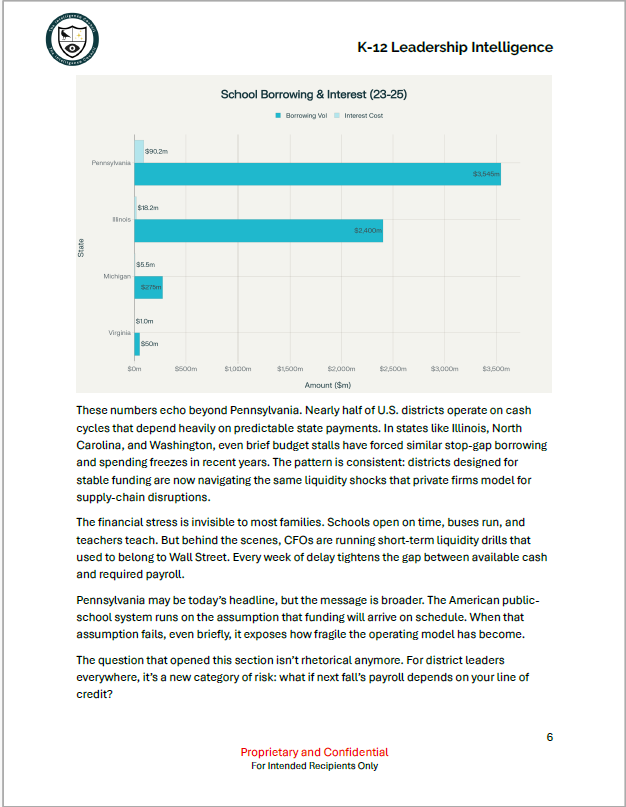

Pennsylvania illustrates the risk. A three-month budget impasse froze more than $3 billion in K-12 aid, forcing at least 27 districts to borrow. Philadelphia alone floated $1.5 billion in short-term notes, paying $30 million in interest that will never reach a classroom. Smaller systems such as Lancaster and Mahanoy Area followed with emergency loans. Similar symptoms are appearing in Illinois, Michigan, and California, where delayed state payments or federal pass-throughs have already triggered borrowing or hiring freezes.

One exhibit in our full briefing visualizes the paradox: states with the healthiest reserves often have districts under the greatest strain. Pennsylvania and Illinois sit high on both axes of the chart—moderate reserves, extreme volatility—while Wyoming and North Dakota remain stable thanks to disciplined cash-management structures.

This report traces how timing risk moves through the system: continuation budgets that quietly erode 3-4 percent of purchasing power, liquidity ladders that now include lines of credit once used only in crises, and staffing “throttles” that determine which positions stay vacant until cash arrives.

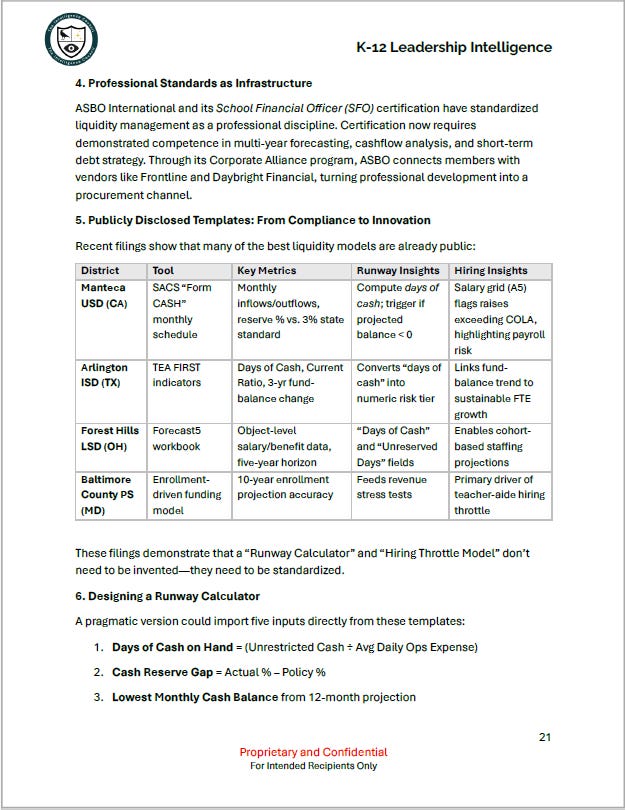

We also profile the tools District CFOs are using to quantify and communicate risk: runway calculators, stress-testing frameworks, and board-ready visuals that convert finance into strategy.

For district and school leaders and the vendors that do business with them, the lesson is simple but urgent: cashflow is now core leadership work. The turbulence in K-12 finance is no longer cyclical; it’s structural. Districts that plan for stability are planning for a world that no longer exists.

Key Findings

- Political delays have become financial events. Each month of state or federal gridlock adds an estimated $0.5–$1 billion in new short-term district borrowing.

- Reserves no longer guarantee stability. Moderate-reserve states such as Pennsylvania and Illinois now show higher district stress than high-reserve peers like Texas and Wyoming.

- Liquidity discipline defines resilience. Districts that pre-authorize credit, stress-test delay scenarios, and communicate cash-flow realities early are withstanding impasses with less instructional disruption.

- The ESSER sunset will magnify risk. With $189 billion in federal relief expiring by 2026, volatility at the federal level will compound state-level timing shocks.

For superintendents and CFOs, the takeaway is clear: financial management can no longer assume predictable aid flows.

The most resilient districts now operate like treasury teams—measuring runway in weeks, not months, and institutionalizing cash-flow discipline as a core function of governance.

The full 30-page briefing with detailed fiscal analysis, risk dashboards, and step-by-step liquidity planning tools is available for paid download.

This detailed briefing has been prepared for superintendents, CFOs, district executives, and the vendors that do business with them. It is intended to support informed discussion and decision-making.

Contents

- Executive Summary

- The New Fiscal Precarity

How even solvent districts ended up borrowing to make payroll—and what that reveals about the new fragility of public-school finance. - The Hazard of Continuation Budgets

Why “keeping the lights on” budgets quietly drain district flexibility and turn inflation into an invisible cut. - The Liquidity Ladder

Inside the playbook district CFOs now use to stay solvent—what gets sold, frozen, or borrowed first when state aid stalls. - Staffing Pacing

How hiring freezes, unfilled vacancies, and “centrally managed reserves” became the new normal for managing uncertainty. - Public Narrative

What the best superintendents said when cash ran out—and how transparent messaging kept their communities calm and boards aligned. - Tools and Tactics for Fiscal Resilience

A first look at the emerging treasury discipline in K–12 finance: runway calculators, liquidity ladders, and board-ready cashflow models. - Financial Planning Tools and the Next Generation of District Runway Models

Profiles of the platforms and templates transforming district finance—from SACS to Forecast5—and what early adopters are learning. - Budget Volatility as the Permanent Operating Condition

Why analysts at Brookings, Bellwether, and Edunomics now say fiscal turbulence isn’t a cycle—it’s the climate districts must learn to operate in.

Sample Contents: